teaser

Pharmaceutical giant Amgen has revealed its cost-cutting drive will push profits higher than previously forecast.

The firm, which is the world’s largest biotech company, now expects earnings of $4.30 per share for 2007.

Amgen chief executive Kevin Sharer made the forecast in a presentation at the JP Morgan Healthcare Conference in San Francisco.

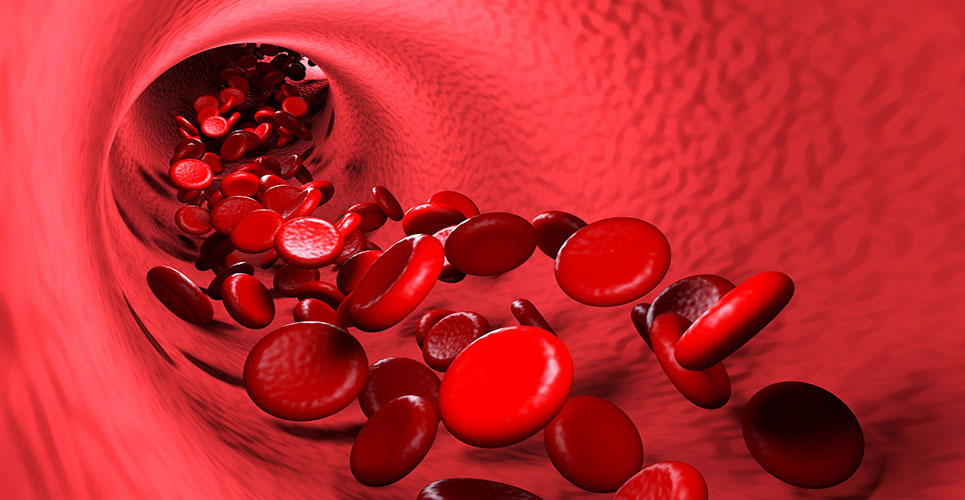

The company’s stock price has fallen over concerns from the Food and Drug Administration (FDA) about its drugs intended to treat anaemia by stimulating production of red blood cells – Aranesp (darbepoetin alfa), and Epogen (epoetin alfa).

The FDA issued a “black box” warning on the two treatments after research suggested high doses could increase the risk of tumours and even death.

Amgen experienced further problems when the Medicare system changed the reimbursement policy for Aranesp and similar medications so doctors are now only paid for prescribing low doses.

Some industry analysts believe the firm’s sales could suffer this year if private insurers follow suit.

But in August, Amgen said it was cutting between 12% and 14% of its workforce, and Mr Sharer now claims the firm is on track to deliver cost savings in 2008 as a result of the restructuring.

Copyright © PA Business 2008

Take part in our prize-draw survey